[ad_1]

A restructuring firm drafted in just a month ago to advise the London-listed gold miner Petropavlovsk has resigned from the role as the expanding scope of Russia-related sanctions hits parts of the City’s professional services sector.

Sky News has learnt that AlixPartners, which is based in the US, stepped back from its role with the gold producer earlier this month following the imposition of new restrictions on the work that management consultants and accountants can undertake for Russian companies in the wake of its war in Ukraine.

City sources said on Friday that BDO, the British-based accountancy firm, had since stepped in to replace AlixPartners as Petropavlovsk’s restructuring adviser.

Although neither the gold producer nor its executives have been sanctioned by the UK government, BDO’s decision to accept the work may nevertheless prompt surprise in the City.

Earlier this month, Liz Truss, the foreign secretary, announced a ban on the export of services including management consulting, accountancy work and public relations.

“Doing business with Putin’s regime is morally bankrupt and helps fund a war machine that is causing untold suffering across Ukraine,” she said.

“Cutting Russia’s access to British services will put more pressure on the Kremlin and ultimately help ensure Putin fails in Ukraine.”

Kwasi Kwarteng, the business secretary, added: “Our professional services exports are extraordinarily valuable to many countries, which is exactly why we’re locking Russia out.

“By restricting Russia’s access to our world-class management consultants, accountants and PR firms, we’re ratcheting up economic pressure on the Kremlin to change course.”

AlixPartners’ mandate was revealed by Sky News at the beginning of April and confirmed by the company in a stock exchange announcement a fortnight later.

Petropavlovsk was hit last month by a demand from Gazprombank, its main lender, for a debt repayment of nearly $300m.

“The company has appointed AlixPartners UK LLP to assist the board as it explores its options and determines the company’s course of action in the best interest of all stakeholders, including creditors and shareholders,” Petropavlovsk said last month.

“These options include the sale of the company’s entire interests in its operating subsidiaries as soon as practically possible.

“It is not currently clear what return, if any, may be secured for shareholders or the holders of the bonds or notes as a result of this process.”

Petropavlovsk, which mines gold in the far east of Russia, said in March that it had been prohibited from making a loan interest payment of $560,000 because Gazprombank had been sanctioned by the UK government.

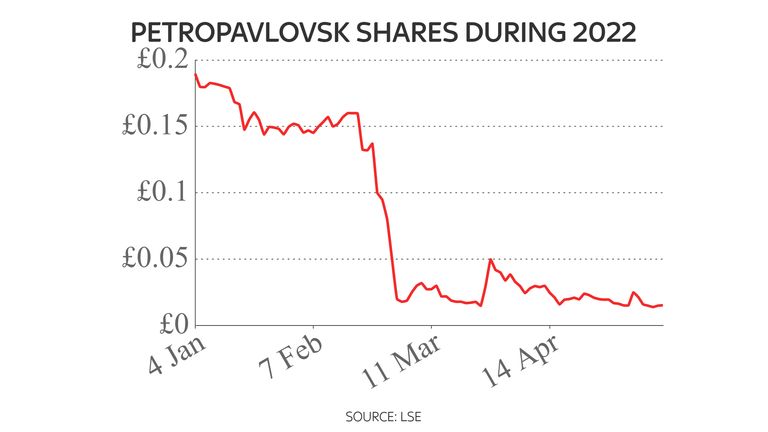

The company has seen its shares plunge to just 1.49p, leaving it with a market value of only £56m.

The stock has fallen by over 90% in the last 12 months.

In recent years, Petropavlovsk has been embroiled in a series of rows involving management and shareholders.

A company spokesman said: “Petropavlovsk is a UK plc and the company is not currently under any sanctions.”

AlixPartners declined to comment.

A BDO spokesperson said: “We do not comment on whether companies are clients or not”.

[ad_2]