[ad_1]

After a torrid session on Wall Street on Monday, stocks are expected to rally today, as they have in Europe.

That does not take anything away from the fact that, so far, 2022 has been a rotten year for stock market investors.

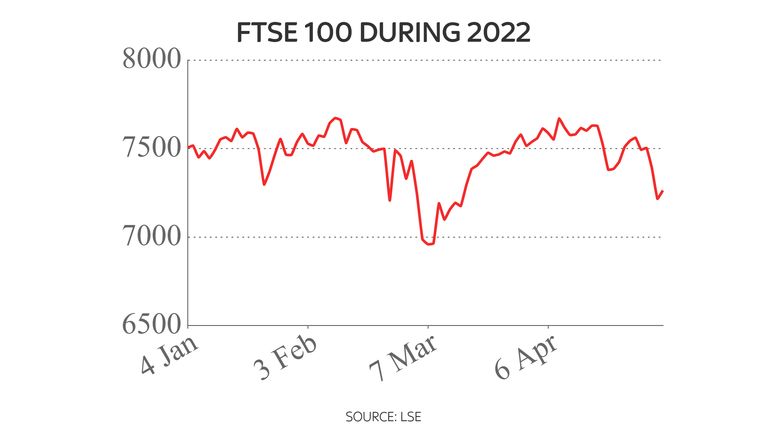

To date, in 2022, the FTSE-100 is down 1.69% while the DAX in Germany is off 14.5% and the CAC-40 in France a similar amount. The MIB in Italy is down by nearly 15.5% and the AEX in the Netherlands by almost 16%.

In Asia, the Hang Seng in Hong Kong is down by 16% so far this year, while the Shanghai Composite in China is off by 16.5% and the Nikkei 225 in Tokyo by 10.5%.

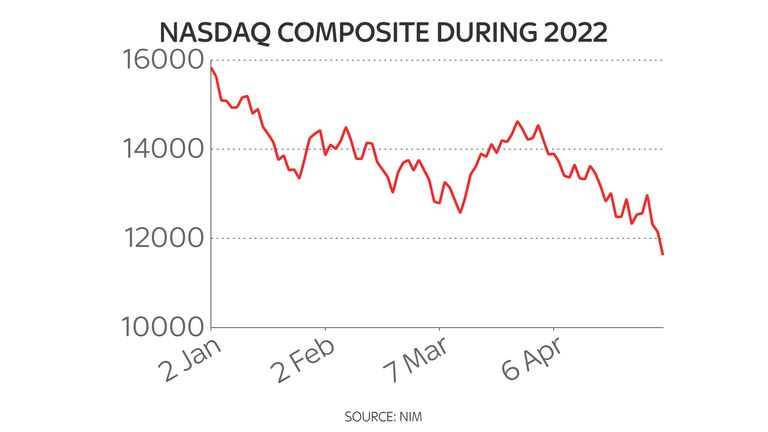

In the United States, it has been ghastlier still, with the S&P 500 down by 16.25%, the Dow Jones Industrial Average by 11.25%, the Russell 2000 – the main index for US smaller companies – by 21.5% and the Nasdaq down by a bone-crushing 25.75%.

There are several factors behind this decline, including uncertainty created by Russia’s attack on Ukraine, although that does not explain why the main US indices have fallen by more than their European and Asian counterparts.

Another is the growing supply chain bottlenecks being created by the re-emergence of COVID-19 in China and the hard-line restrictions that Beijing has imposed in response.

That relative weakness is explained by the biggest and most important factor behind these global reverses – the growing threat of inflation and the actions being taken around the world by central banks such as the US Federal Reserve and the Bank of England in response.

The Fed last week raised its main policy rate by half a percentage point, its biggest such increase in two decades, while the Bank raised its main policy rate for the fourth time in as many meetings.

But this is not something just happening in the US and the UK.

Right around the world, central banks are tightening monetary policy, including the central banks of South Korea, Canada, Sweden, Poland, Israel, Chile, South Africa and Mexico. Perhaps the most notable of late was the Reserve Bank of Australia which, last week, raised interest rates for the first time since November 2010.

It has raised concerns in the minds of investors as to the extent to which global growth are going to be hit by these rate hikes and, by extension, the corporate profits that drive share prices higher and which allow businesses to pay shareholders dividends.

Some investors fret that central banks like the Fed and the Bank are ‘behind the curve’, in the jargon, when it comes to inflation – raising the risk that interest rates will have to be increased more than they would have done had these institutions acted more rapidly.

The Fed is also about to embark on so-called ‘quantitative tightening’, unwinding a portion of the extraordinary asset purchases it carried out during the pandemic to keep liquidity flowing through financial markets, which has the same impact as raising the cist of borrowing.

The Bank was also expected to announce something similar last week but, for now, this appears to have been parked in the ‘too difficult’ box.

The overall threat of higher inflation and of central banks unwinding some of their asset purchases has sent yields (which rise as the price falls) on government bonds higher. The yield on US 10-year Treasury bonds on Monday this week hit its highest level since November 2018 and, since the beginning of the year, has risen from 1.51% to 3.20% at one point on Monday.

That is a huge increase in such a short space of time. For UK 10-year gilts, the increase has been just as dramatic, with yields rising from 0.972% at the beginning of the year to 2.073% at one point on Monday – a level it has not seen November 2015.

Even in the eurozone, where there is a much lower prospect of the European Central Bank unwinding its pandemic-era purchases, yields have been rising.

The yield on German 10-year bonds currently stands at its highest level for eight years. Of greater concern, bringing back memories of the eurozone sovereign debt crisis, is the widening of the ‘spread’ between yields of differing government bonds in the bloc. For example, the yield on Italian 10-year bonds is currently 3.077%, compared with just 1.06% for German 10-year debt.

These increases in bond yields have an impact on the equity market, nowhere more than in the tech sector, where the sell-off has been most brutal.

An estimated $1trn has been wiped from the collective value of leading US tech stocks during the last three trading days, with Tesla falling in value by $199bn, Microsoft by $189bn, Amazon by $173bn and Alphabet, the parent of Google, by $123bn.

Tech stocks are more vulnerable to expected increases in interest rates. This because the share price of any company merely reflects what investors are prepared to pay for future cash flows from that company in future – and, as tech companies are assumed to have better growth prospects in the longer term, those expected future cash flows have tended to earn them a higher stock market rating.

However, when bond yields rise, the present values of those future cash flows tend to fall – because it becomes more difficult for investors to justify holding highly-valued tech stocks when they could be holding less risky assets, such as government bonds, paying them more today.

This is something investors have started to factor in since, in January, the Nasdaq entered ‘correction territory’.

The more over-rated a stock was previously, the further it has to fall now, while the sell-offs have been particularly hard for those tech companies that have been afflicted by particular issues.

Netflix, for example, has seen its shares fall by some 64% during the last year after reporting its first quarterly drop in subscriber numbers in more than a decade.

Amazon, meanwhile, is down by some 30% over the last 12 months after spooking investors with its first quarterly loss since 2015 amid growing concerns about the extent to which online shopping is slowing. Peloton, another former tech darling, today became the latest to disappoint investors with its most recent sales figures.

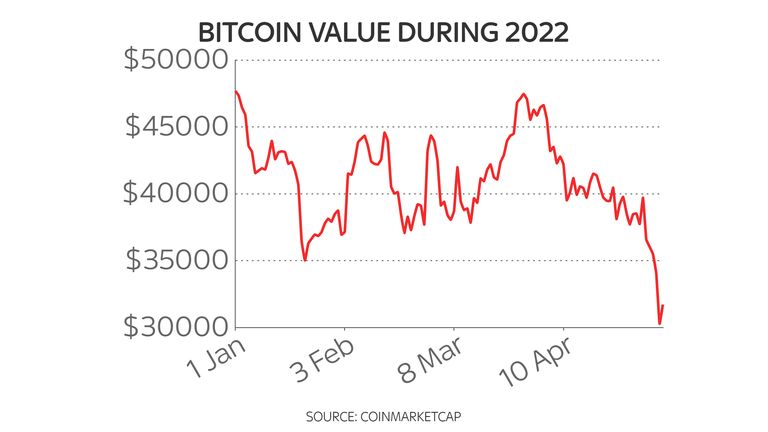

Tech stocks are not the only risk assets to have endured a big sell-off. Crypto-assets, which tend to trade very much like tech stocks, have also endured a pasting. Bitcoin has fallen by 35% since the beginning of the year and has hit a price last seen in July last year.

The question is the extent to which stocks fall from here – with many investors remaining deeply pessimistic.

Max Kettner, chief multi-asset strategist at HSBC, told clients on Tuesday: “The performance across asset classes of the past few weeks can be described in one word: brutal.

“Our view remains firmly risk-off. Pretty much all our fundamental and cyclical indicators clearly point to a growth scare coming – not in 2023, but in the next three to six months. As such, despite our short-term sentiment and positioning indicators already being downbeat, we remain firmly risk-off.”

And Bill Blain, strategist for the investment management firm Shard Capital, said: “I remain convinced global stocks and shares are massively overpriced relative to the prospects for the global economy. That’s not just because of the deepening new Covid lockdown crisis in China (which threatens a catastrophic repeat of 2020-21 supply chain breakdowns), energy and food inflation, the Ukraine war, but also unravelling the consequences of 12 years of monetary experimentation and cheap liquidity distorting markets.”

These views are by no means untypical. Global growth is slowing and, with it, corporate profits are set to slow for those businesses forced to absorb the impact of higher inflation. For those companies benefiting from higher inflation meanwhile, such as oil and energy companies, the threat of windfall taxes may loom ever larger.

There may be rallies as has been seen today, as bargain-hunters step in.

But it does not feel, just now, as if the sell-offs that have characterised markets of late are over yet.

[ad_2]