Sofi Stock Forecast 2023: Is it a Buy for 2023?

SoFi is expanding its deposit base, now totaling $12.7 billion. This growth not only reflects customer confidence but also helps lower funding costs, as deposits typically have lower interest rates compared to other capital-raising methods.

Sofi Technologies SOFI Stock Forecast 2023 is $8.7

Latest SOFI Stock Price

Sofi Stock Performance Summary

| Last 5 Days | +7.8% |

| Last 1 Month | -3.3% |

| Last 6 Months | +54.4% |

| Last 12 Months | +48.1% |

Sofi Stock Price Target for next 12 months(Analysts)

| Overall Average | $9.5 |

| Truist | $14 |

| Morgan Stanley | $7 |

| Keefe, Bruyette and Woods | $7.5 |

Sofi Stock Price Prediction for the Next 4 Years

- Sofi Stock Price Prediction 2023 is $8.11

- Sofi Stock Price Prediction 2024 is $15.2

- Sofi Stock Price Prediction 2025 is $22.0

- Sofi Stock Price Prediction 2026 is $24.0

Sofi Stock Forecast Today

UTC: Feb 23rd, 2024 12:05 AM

- Sofi Stock Price Prediction in the next 24 hours is between $8.09 and $8.28

- Sofi Stock Price Prediction this week is between $8.04 and $8.33

UTC: Feb 23rd, 2024 12:16 AM

| Overall Outlook | Neutral |

| 1. Market’s Wisdom | Partially Bullish |

| 1a. Market Data | Partially Bullish |

| 1b. Technical Recommendation | Neutral |

| 2. Crowd’s Wisdom | Partially Bearish |

| 2a. Social Media Buzz | Lower |

| 2b. Social Media Sentiment | Steady |

Sofi Stock Forecast 2023: Q3 result

- Adjusted EBITDA of $98 Million, a 121% increase year-over-year.

- New Member Adds: Over 717,000; Quarter-End Total Members: Over 6.9 Million, 47% increase year-over-year.

- Total Deposit Growth: $2.9 Billion, 23% increase during Q3 to $15.7 Billion.

- GAAP EPS loss reported: $0.29; EPS loss excluding Goodwill Impairment: $0.03.

- Total new products added: Nearly 1,047,000; Total products: Over 10.4 Million, 45% increase year-over-year.

- 67% of adjusted net revenue growth from non-Lending segments.

- Net interest margin: 5.99%; Record adjusted EBITDA margin: 48%; Overall margin: 18%.

- Excluding Goodwill Impairment: Net loss of $19.5 million and EPS loss of $0.03.

- 2023 guidance: Adjusted net revenue: $2.045 to $2.065 billion; Adjusted EBITDA: $386 to $396 million. The company expects GAAP profitability in Q4 2023.

Will SOFI Stock Recover?

Sofi Technologies, an online bank and financial service provider, reported a Q2 2023 loss of $47.5 million, primarily due to its significant exposure to student loans and the uncertainty surrounding its future amidst an extended loan payment moratorium. Additionally, substantial losses from personal loans added to their challenges. The absence of a clear strategy for loan recovery, coupled with concerns about a potential recession, may lead to a decline in SOFI stock. To improve its prospects, Sofi will likely need to diversify its portfolio.

Sofi Stock Forecast 2023: Bull Case

- Bank Charter is the new ray of hope- Sofi finally managed to get a bank charter after a lengthy process that allowed Sofi to gather and hold deposits and then use them to fund the loans. It also makes way for loan origination in-house which will save money and time for its customers.

- Composition of loan portfolio – As of March 31, approximately 98% of the loan portfolio is made up of personal loans and student loans. These types of loans have shorter terms compared to the long-dated Treasuries that the failed regional banks held. As a result, the loan portfolio is less affected by fluctuations in interest rates.

In the recent quarter, SoFi Bank attracted $2.7 billion in deposits, providing management with strategic options for these funds and originating loans. This flexibility led to a remarkable 73% YoY revenue surge, reaching $676.8 million in Q2 FY 2023. These strong results align with the bank charter becoming operational, giving SoFi a competitive advantage over peers like Upstart Holdings Inc. Consequently, the bank charter is expected to drive substantial revenue and customer growth in 2023, which will be very positive for SOFI stock.

- Results Speak Better than Words – A decade earlier, Sofi was only a student loan refinancing company that had gradually diversified its business and lending products. As a result, Sofi has not only seen growth in revenue but also growth in the number of new members being added to its platform.

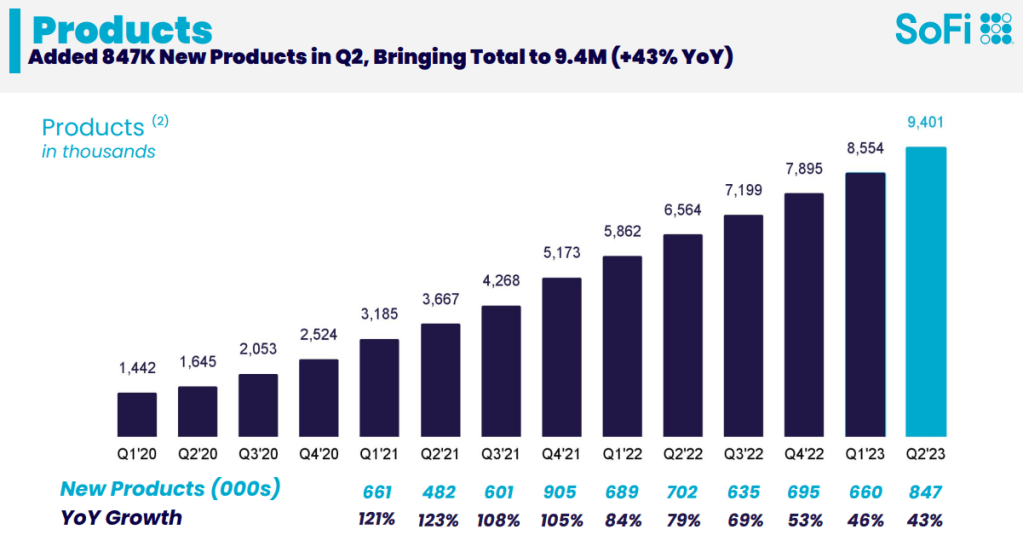

*Source: Investor’s presentation: Q2, 2023 Results

The number of new products added is increasing every quarter and that is attracting new members. This growth may decelerate, but it is still much higher than its peers and that makes Sofi a leader in its niche.

- Federal student loan repayments have been on hold for over three years, but the Supreme Court ruling against President Biden’s student loan forgiveness means that loan payments will resume in October, and interest will start accruing again in September. At the end of Q2, student debt in the United States amounted to around $1.57 trillion, as per the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit.

In 2023, student loan refinancing revenue can be back on Sofi’s balance sheet and it can be a major boost for the company heading into 2023.

Sofi Stock Forecast 2023: Bear Case

- Lack of Transparency with the Future of Loans- The Bank Charter is positive news for Sofi, but the management is very opaque regarding the strategy for the Bank Charter. It said that it plans to hold loans for six months, collect the recurring interest incomes, and then sell the loans to investors.

Sofi, although serves a very high-quality customer base and its loan portfolio, has a weighted FICO score of 748, but demand for a personal loan is depleting as reported by its peer Lending Club in the recent quarter.

Going into 2023, house loan originations will still be dull due to very high interest rates and Sofi will get into trouble if personal loans are not sold to investors as expected.

If an investor has some risk appetite, SOFI must be in his portfolio for 2023 to witness the awesome growth story for this fintech stock.

Is Sofi a good investment?

SoFi is a financial technology company that offers a variety of financial products and services, including student loans, personal loans, mortgages, and investment products. The company has a strong track record of growth, but it is also a relatively new company and is not yet profitable. As a result, there is some risk involved in investing in SoFi. If you are looking for a growth investment, SoFi could be a good option. The company is expanding its product offerings and entering new markets, which could lead to significant growth in the future. However, if you are looking for a more conservative investment, SoFi may not be the best option.

Ultimately, the decision of whether or not to invest in SoFi is a personal one. You should carefully consider your investment goals and risk tolerance before making a decision.

Note: Predictions and data from all over the net and has no in-house view on the likely trends in the Stocks or Crypto Coins. Please consult a registered investment advisor to guide you on your financial decisions.

Source link