[ad_1]

When Elon Musk declared on 4 April that he had become the biggest single shareholder in Twitter there was much head scratching as to why the Tesla chief executive had taken his 9.2% stake.

Some commentators assumed he was just having a bit of fun.

A few days earlier, he had run a Twitter poll, in which he asked his 81.6 million followers: “Free speech is essential to a functioning democracy. Do you believe Twitter rigorously adheres to this principle?”

He later followed this by saying: “The consequences of this poll will be important. Please vote carefully.”

More than 2 million people voted and seven in 10 of them answered ‘no’.

That statement has led most commentators to assume he had already taken his stake at that point.

The poll and the timing of the announcement led some in the market to think that Mr Musk, who tends to have a libertarian – some say absolutist – view of the world when it comes to free speech, merely wanted to put pressure on the Twitter board.

But other commentators assumed the mercurial Mr Musk’s motivation ran deeper than that.

Dan Ives, an experienced tech sector analyst at broker Wedbush Securities, told clients that day: “Given Musk’s long standing critical view of Twitter and social media platforms, it was viewed that Musk could look to build a new social media platform to compete with Twitter and others.

“Instead it looks like Elon has his eyes laser set on Twitter and we would expect this passive stake as just the start of broader conversations with the Twitter board/management that could ultimately lead to an active stake and a potential more aggressive ownership role of Twitter.”

He was right. The following day, Twitter appointed Mr Musk to its board.

There then followed an embarrassing 72 hours in which Mr Musk mocked Twitter, issuing a series of tweets in which he criticised the platform.

In one, he asked his followers if they thought Twitter was dying, pointing out that some of Twitter’s most followed accounts, including those of musicians Taylor Swift and Justin Bieber, rarely tweeted.

In his most incendiary tweet, he posted a poll asking whether Twitter’s headquarters in San Francisco should be converted into a shelter for homeless people, adding: “no one shows up anyway”.

This was the precursor for announcing, on Monday, that he would not be joining the board after all.

Twitter put a brave face on the decision, its chief executive Parag Agrawal declaring publicly that it was “for the best”, but privately the company’s management would have been bitterly disappointed.

Part of the arrangement that would have seen Mr Musk join the Twitter board was that he would be limited to taking a 14.9% stake in Twitter.

All of a sudden, once again, Mr Musk was outside, not inside, the tent and free to take as big a stake in the social media platform as he liked.

And the tactics suddenly made sense when Mr Musk went public with his $41.39bn offer on Thursday.

He said: “I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

“However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

“As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

“Twitter has extraordinary potential. I will unlock it.”

One thing to note straight away is that Mr Musk is not messing around. He has appointed Morgan Stanley, one of Wall Street’s biggest banks, as an adviser on the offer.

There has to be a strong chance that Mr Musk will succeed in winning control – although perhaps not at this rather opportunistic price.

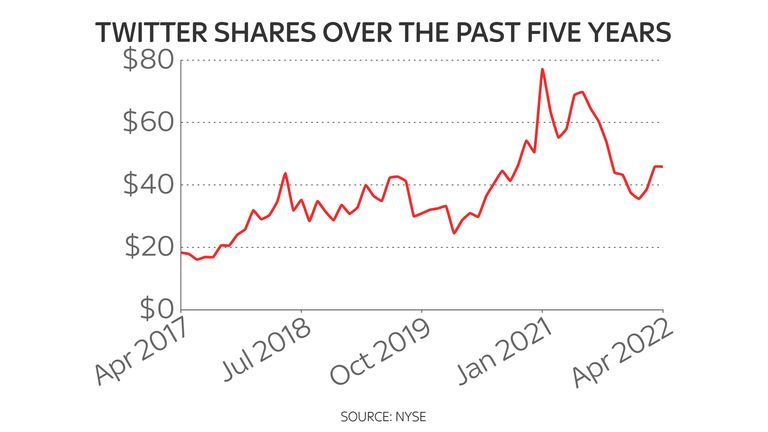

Twitter shares were changing hands at north of $78 as recently as February last year and so the company’s board is unlikely to accept an offer at this price. Alternatively, they may try to get an auction going, shopping around for a ‘white knight’.

That is why Mr Musk has couched his approach as a ‘take-it-or-leave-it’ offer. It is an attempt to get Twitter, in the jargon, in a ‘bear hug’. He wants Twitter’s board to think that, if he walks away, the share price will tank.

But some investors may snatch at an attractive offer given that, only last month, the share price touched $31.95.

It is worth noting, though, that when Wall Street opened for business, Twitter shares only rose by 4% or so, failing to hit his offer price.

That reflects a fair degree of scepticism that Mr Musk can achieve a takeover. Memories remain of a notorious tweet Mr Musk sent in 2018 when he said he had “funding secured” for a $420-a-share takeover of Tesla. That earned both him and Tesla $20m fines from the US Securities & Exchange Commission.

Gene Munster of Loup Ventures told CNBC: “He can probably get control of Twitter here around that price and I think shareholders should welcome it.”

“He has 81 million followers out of 215 million total monthly Twitter subscribers – so one in four he’s got influence on.

“It’s really exciting here from an investor standpoint to have the company under the control of somebody who wants to make some really profound changes.”

The question is, if Mr Musk succeeds, what changes those would involve. He has mused in the recent past, for example, about issuing an authentication ‘check mark’ for premium subscribers. He may also look to move from an advertising-based model to make Twitter a business funded by subscriptions.

Another question is whether Mr Musk plans to try and buy Twitter outright. With an estimated net worth of $265bn he can afford to, in theory, except a lot of that wealth is tied up in Tesla shares.

So it may well be that he will borrow against those shares, using them as security, although alternatively he could seek the backing of a private equity company. Alternatively, he could try to sell some of his Tesla shares to raise cash, a reason Tesla shares fell by more than 3% on Thursday afternoon.

The big question most Twitter users will have is whether the platform will change in character following a takeover.

Twitter’s management – both Mr Agrawal and before that the company’s co-founder Jack Dorsey – have tried hard, not always successfully, to make Twitter a platform where the discourse is reasonably civil.

That has included using moderation policies that a lot of people, presumably including Mr Musk himself, regard as too heavy-handed.

So some will fear a takeover might result in more trolling and, perhaps, a lifting of the ban on former US president Donald Trump.

All these are questions to which an answer will not immediately be available.

And that lack of clarity will leave many users – and especially Twitter employees – rather nervous.

[ad_2]