[ad_1]

Billions were wiped off the FTSE 100 on Thursday as investors around the world reacted to fears of an inflation-fuelled recession.

The blue-chip index slumped 1.8%, joining a rout in global markets.

Royal Mail led the fallers, down by 12%, after it warned of a battle to control soaring costs.

Unilever, Diageo, Reckitt Benckiser, and British American Tobacco saw drops of between 1.7% and 5.3%, while supermarket chain Tesco plunged nearly 4.1%.

The sell-off comes near the end of a brutal week that saw the worst losses for US stock markets since June 2020.

The Dow Jones Industrial Average fell by 3.6% and the broader S&P 500 by 4% on Wednesday after a series of retailers posted disappointing financial results with evident damage from the pace of inflation.

The Dow dipped a further 0.75% on Thursday, while the S&P 500 by another 0.6%.

Market analysts pointed to an update from Target, one of the biggest retailers in the US, as prompting the hard risk-off approach on Wednesday.

Its shares plunged by 25% – it’s worst daily performance since 1987 – after the company pointed to rising cost pressures, stoking investor fears around inflation.

Its quarterly results also badly missed analysts’ forecasts.

Other retailers echoed Target’s sentiment, saying their profits were hit by slow sales, supply chain issues and spiralling costs.

Shares of Dollar Tree, Dollar General and Costco Wholesale also took a sharp tumble.

The sell-off marked a sharp reverse from Tuesday, when markets rebounded after a strong performance by key technology stocks – shares that were credited with leading the US stock market recovery from the shock of the early pandemic.

However, a 40-year high for US inflation and the prospect of a series of sharp interest rate hikes ahead has spooked investors and damaged the so-called growth stocks.

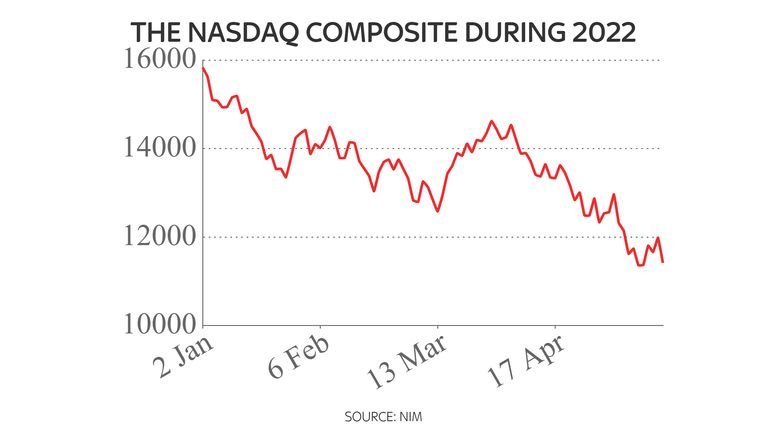

The tech-focused Nasdaq entered correction territory in January and has continued to suffer since.

It fell by 4.7% on Wednesday – its second-worst day of the year – with Apple falling by more than 5%.

Tesla was also among the biggest losers, down by 7%.

“Inflation is hitting every aspect of an earnings report, whether it be the transportation side or supply-chain disruption,” Nick Giacoumakis, president and founder of NEIRG Wealth Management, told the Wall Street Journal.

“Customers are no longer buying the more expensive items they would typically buy. All this trickles through to an earnings report.”

[ad_2]